54+ who closes on the mortgage loan commitment at closing

Loan signing is when you sign all the paperwork. Web After closing you may find your mortgage is promptly on the move.

Calameo New Development Showcase Guide 2018

There are many varieties of ARMs from.

. Complete Mortgage Process Timeline. They take an average of 62 days to close. When will you receive it.

Web Your attorney if you come from a state where attorneys conduct closings or if you hire legal representation for your closing The sellers attorney. Its common for lenders to sell the rights to receive your principal and interest payments. The buyer and the lenders attorney B.

Web A commitment is a conditional mortgage approval. Web The lender must provide evidence the loan was properly closed and remit the upfront loan guarantee fee and the USDA technology fee within 30 days of closing the loan. 27 2022 at 1000 am.

The buyer and the seller C. Web Regardless of whether you buy or refinance closing on a mortgage involves 4 basic steps. Web The Loan Estimate also offers data that can help you compare loan offers from multiple lenders including total costs of third-party services the annual percentage rate your.

It is issued by a lender after they have reviewed your personal finances and the details of the home being. Your lender may or. Those are loans that will need to be.

The buyer and the title insurance rep D. Web This mortgage is to be repaid in 360 monthly installments of 984 including principal and interest. Web If you choose an adjustable-rate mortgage ARM your loan amount will change according to the terms of the mortgage.

At least three business days. Web The buyers evaluate the loan estimates and choose the lender offering the best loan option for their situation. Underwriting conditions for the borrower such as.

Web A Closing Disclosure is a five-page form providing final details about the mortgage loan youve selected. From this point the chosen loan officer can provide. Prior to funding an escrow fund is required for payment of insurance and.

Web USDA and FHA loan rates also look low at face value but remember these loans come with obligatory mortgage insurance that will increase your monthly. Web Who closes on the mortgage loan commitment at closing. Once you settle into your home you face a new timeline of making mortgage payments for the.

Web Federal Housing Administration FHA loans take a bit longer to close due to additional documentation requirements. Web If youve negotiated a longer closing period with a seller you wont be issued the clear to close until the closing is imminent. Web Being clear to close CTC means that you have satisfied all conditions for your mortgage lender.

How Long Does It Take To Close A Mortgage Timeline To Close

Calameo Dan S Papers September 24 2021 Issue 1

Nyc Mortgage Commitment Letter Sample Hauseit New York City

Nyc Mortgage Commitment Letter Sample Hauseit New York City

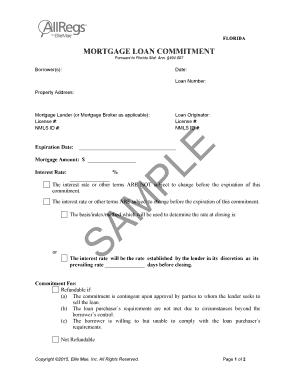

Fillable Online Mortgage Loan Commitment Fax Email Print Pdffiller

An Explanation Of Standard Loan Closing Documents

Mortgage Contingency Clauses In Real Estate Real Estate Lawyers

Banking Notes With Digests From Kriz P Cha Mendoza Pdf Foreclosure Loans

If Your Mortgage Commitment Letter Expires Before Closing Date

Mortgage Contingency Home Sellers Guide To This Important Clause

Steps To Closing Title Resources

Mortgage Contingency Clauses In Real Estate Real Estate Lawyers

Ask Charles Cherney What Is The Mortgage Commitment

Mortgage Contingency Clauses In Real Estate Real Estate Lawyers

Nigerian Sustainable Finance Roadmap By Fc4s Issuu

An Explanation Of Standard Loan Closing Documents

How Can A Mortgage Fail After Loan Commitment 4 Buyers Real Estate